+1(209) 348-9544

order@myessayservices.com

+1(209) 348-9544

order@myessayservices.com

![]() Are you in High School, College, Masters, Bachelors or Ph.D and need someone to help write your essay or research? We offer premium quality essay writing help. All our papers are original, 0% plagiarized & uniquely written by our dedicated Masters specialists. My Essay Services is an experienced service with over 9 years experience in research writing of over 97,000 essays over the years. You will receive a plagiarism check certificate that confirms originality for any essay you order with My Essay Services. Fill the calculator on your right to begin placing your order now!

Are you in High School, College, Masters, Bachelors or Ph.D and need someone to help write your essay or research? We offer premium quality essay writing help. All our papers are original, 0% plagiarized & uniquely written by our dedicated Masters specialists. My Essay Services is an experienced service with over 9 years experience in research writing of over 97,000 essays over the years. You will receive a plagiarism check certificate that confirms originality for any essay you order with My Essay Services. Fill the calculator on your right to begin placing your order now!

Health insurance can be described as insurance that is often against the risk of incurring medical expenses amongst different persons. In the case of the 50 employees, I would definitely go for the group health insurance. The Group health insurance can be described as an employer sponsored insurance that covers for small businesses. Group Health Insurance is affordable and coverage includes the employees and their family members (Peterson, 2010). This insurance plan is important and has been used by many small businesses when it comes to hiring as well as retaining the best works. The insurance company that one wishes to join when it comes to group health insurance estimates the costs based on the risk factors of the employees and their nature of work.

Health insurance can be described as insurance that is often against the risk of incurring medical expenses amongst different persons. In the case of the 50 employees, I would definitely go for the group health insurance. The Group health insurance can be described as an employer sponsored insurance that covers for small businesses. Group Health Insurance is affordable and coverage includes the employees and their family members (Peterson, 2010). This insurance plan is important and has been used by many small businesses when it comes to hiring as well as retaining the best works. The insurance company that one wishes to join when it comes to group health insurance estimates the costs based on the risk factors of the employees and their nature of work.

They then go forward and give a final monthly cost for the group health insurance plan once they have assessed everything. It is important to understand that because the company has fifty employees, the company is eligible for this plan and can therefore, be able to provide the workers with a good and reliable insurance plan. Therefore, the Group Health insurance plan is the best insurance plan for the company that has 50 employees, this is because the company can be able to pay the payments comfortably and the plan is reliable and efficient.

The Affordable Health Care Act also referred to as Obama Care states that for a company that has fifty employees or more, there is a need for the company to offer health insurance to the workers. Therefore, the company is obligated by law to have an insurance plan for its employees and this is not just a matter of choice of whether the company wants to or not (Peterson, 2010). The Affordable Health Care Act, has been instrumental when it comes the development of health insurance amongst employees and ensuring that employees get quality and affordable health care act.

Read about health insuarance in USA and Costarica

Therefore, the Group Health Insurance will be important and will ensure that indeed the workers are given the relevant insurance that is stipulated in the Affordable Health Care Act at a reduced cost.

The first advantage of purchasing insurance for employees is that one can be able to hire and retain employees because of a great insurance policy. Another advantage is that the employees can pay for the health insurance by working extra hours or even at times by being more productive (Peterson, 2010). The main disadvantage of purchasing health insurance for the employees can be the fact that company might incur losses by trying to retain the employees by having an attractive insurance plan. Another disadvantage, is that government insurance is cheaper than employer purchased insurance.

The main advantage of employees receiving governmental insurance is that it is cheaper and therefore, more affordable. Secondly, another advantage of governmental insurance as opposed to employer purchased insurance is that it does not elapse once one is fired. The main disadvantage is that there is often a lot of bureaucracy when it comes to governmental insurance. In order for one to get a claim, it often takes a long process and consequently most people often avoid the governmental insurance.

Secondly, it is important to understand that another main disadvantage of employees receiving governmental insurance is the fact that it is not as attractive as compared to governmental insurance. Therefore, there are several advantages and disadvantages associated with each of the methods. Therefore, there is a need for the employer to better understand the best insurance plan in order to choose and give the employees the best offer.

References

Peterson., K (2010) Health Insurance: Group Health Insurance and why it matters. Journal of HealthCare.

Melnyk, Bernadette M, and Ellen Fineout-Overholt (2011). Evidence-based Practice in Nursing & Healthcare: A Guide to Best Practice. Philadelphia: Wolters Kluwer/Lippincott Williams & Wilkins.

Introduction

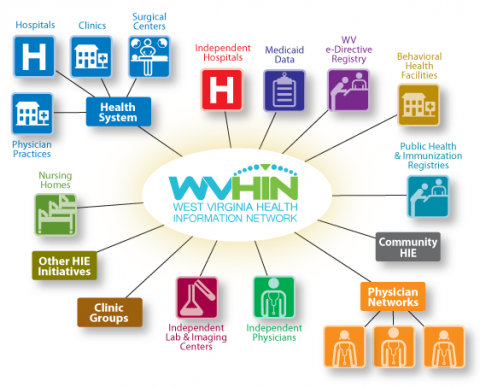

The world, today, is adopting computerization in majority of the systems at business and personal level. Computerized systems are used to store database, ease communication and allow connectivity through the use of distributed systems. Over the years, hospitals have been storing patient's information and data on physical files. However, there is increased pressure on hospitals, physicians and clinics to embrace the use of electronic medical records. EHR systems provide a platform for connecting inpatient and outpatient care and hence ensure coordination of services (Busch, 2008).

The world, today, is adopting computerization in majority of the systems at business and personal level. Computerized systems are used to store database, ease communication and allow connectivity through the use of distributed systems. Over the years, hospitals have been storing patient's information and data on physical files. However, there is increased pressure on hospitals, physicians and clinics to embrace the use of electronic medical records. EHR systems provide a platform for connecting inpatient and outpatient care and hence ensure coordination of services (Busch, 2008).

Manufacturers come up with applications to serve different purposes. This also calls for expertise on the side of the user. If the user is not conversant with the use of the application or computer program, it becomes impossible for him/her to utilize the application. Hospital management must be ready to put in the necessary expertise to work with the systems. While electronic record system has several advantages, there are critical issues in its implementation that the need to be resolved.

Reasons for reluctance to implement EHR

Amidst all the advantages that come along with the implementation of EHR systems, some hospitals and medical facilities are still reluctant to embrace them. These hospitals have a long list of reasons that they would put across to support their reluctance to the adoption of the EHR systems. The first reason, which is very legitimate, is the issue of privacy. Health records are among the most secure databases and exposing patient's files exposes their confidentiality (Busch, 2008).

Although software manufacturers have made efforts to improve information security, viruses and unauthorized access on data are still critical issues that affect data stored in computers. Patient's data becomes exposed to hackers and folks not forgetting local vendors and technicians who are called upon to scan computers or repair the systems. The management to various health care facilities prefers to remain in the old filing system rather than compromise patient's privacy.

Second, health specialists fear the introduction of errors into patient's records. A person may argue that an error on paper is equivalent to an error on a computer file. But the greatest fear does not even lie on unintentional error made on the record. Since data stored on computers is accessible by different people including malicious hackers, data could be altered without the knowledge of the administration. This means that the system will contain erroneous data. On the other hand, paper records contain stamps and signatures by the responsible experts.

This makes it easier to track generic records that may be incorporated into patient's data. Health practitioners fear that the introduction of EHR may introduce critical errors onto customer records unless there are systems to prevent the occurrence of errors.

The third but not the least is the issues of cost. It is important to agree to the fact that change comes with a considerable extra cost on the organization. Good EHR systems are expensive and cheap ones are highly vulnerable and inefficient. Most primary health care providers are not ready to bear the extra cost on top of the rising practice cost and huge Medicare pay cuts constantly glaring at them. Most health facilities and hospital financial capabilities may not withstand the cost of EHR without straining other operations within the medical field.

Impact of HIPAA on patient's medical records

The health insurance portability and accountability act (HIPAA) has been in operation since 1996. It provides a set of privacy and security rules to safeguard patient's records. The act has two major roles which are identification of protected health information and to identify protection (Busch, 2008). For electronic records, HIPAA provides security rules for access and processing standards. Its documentation was a major milestone towards ensuring security for heath records. With the aid of HIPAA, several cases of malpractice and mismanagement of health records have been eliminated.

Advantages of HITECH

The health information for economic and clinical health act (HITECH) builds on the principles laid down by HIPAA security initiatives. HITECH has played a major role in helping the healthcare industry to adopt an information security culture through the provision of incentives (David & Marilyn, 2010). The incentives allow hospitals and other health facilities to acquire secure electronic medical records. In addition, HITECH has an alternative form of fund called meaningful use (citation). Implementation of HITECH involves a short and simple procedure. For instance, it is possible to use it on a patient's record even if the patient has issues or controversies with patient protection and affordable care act (PPACA). Professionals in the field of healthcare benefit from a comprehensive foundation for evidence based care that the Act provides. With this system, key medical documents can be accessed severally without having to create new ones every time.

Limitations of implementing HITECH

Amidst the great significance off HITECH to professional health worker, there are some limitations that follow its implementation. One of the limitations is that its long term viability is not yet verifiable. For this reason, the management to medical facilities is unable to make accurate plans for the future. HITECH program is resource intensive and could turn out to be highly expensive if implementer are not careful n the use of resources. Some adjustments need to be done in order to achieve the most compliant and cost effective.

The problem of viability in the coming years is not a serious one now but could be a critical challenge in the years to come. To curb this problem, the founders of HITECH act should pay particular attention to the framework. More focus should be put towards creating a platform that ensures common professional practice infrastructure (David & Marilyn, 2010). This will allow the development of standards for quality interoperability at the point of care.

A typical workflow within a health organization

A workflow is a set of tasks arranged in chronological order and grouped into processes. Unlike other work places, health care facilities have well designed workflows. In some cases, workflows may start as random procedures and evolve into complex ones. A general hospital workflow allocates different experts to specific processes interactively. It is in the interaction of different processes that conflicts arise. However, the presence of a workflow hides some of these conflicts as experts in different areas assume their respective roles. A workflow is also essential in eliminating processes that are no longer necessary in a particular organization.

Every patient follows a particular path during treatment where he/she interacts with experts in different departments. The different medical officers must work together to ensure that the patient receives the appropriate care and medication. A normal care path may start from number allocation or admission and end with the cashier or as set by the hospital management. This path defines the workflow of a clinic or medical facility.

With the introduction EHR, the process of admission becomes unnecessary for people who may have visited the hospital earlier. Patients no longer require special cards in order to get to the observation room. The doctor can use the hospital database to call in the patients using their unique numbers. On the other hand, new patients are required to provide their details for record keeping. However, on the second and subsequent visits the process of admission is not repeated. Even patients suffering from chronic ailments are relieved from the task of requesting their medical files. The doctor is accesses the data on previous treatments from the database without having to look for the patient's physical file.

The impact of key federal initiatives on patient's privacy, safety, and confidentiality

The protection of physical health records was proposed back in the 1990s with the aim of controlling the cost of health services. The task was easy in the beginning, but with the increase in use of electronic medical records, there was a need to develop better privacy and confidentiality protections. The major federal initiatives aimed at protecting patient's records include the Health Insurance Portability and Accountability Act (HIPAA), federal information security management act (FISMA) and the privacy act. FISMA requires that the government information, which consists of health records and personal identity information, be classified and protected depending on the level of risk that misuse of such data poses to the owner. The act also provides guidelines and restrictions on the number of technical, operational and management controls that can be set n the data. The federal initiatives collectively provide a set of rules that ensure that patient's data is safe from malicious use let alone unauthorized access.

HIPAA was developed to motivate more members of the health sector to adopt electronic recording systems and transactions (Busch, 2008). The act introduced new administrative and transaction rules. Most of the provisions in this act target the cost and efficiency in health facilities. Through the use of electronic technology, the act can increase efficiency and reduce cost. The most significant achievement of the act is that it managed to address the issue of confidentiality and safety for personal medical records.

The federal initiatives are part of the state law and should be applied to the latter. Violation of the guidelines stated as per the acts invites a penalty which may include a heavy fine, a jail term or cancellation of the work permit if it involves a worker in the health department. Federal initiatives have a great impact on the protection of patient's records hence ensure privacy and confidentiality. The penalties owing to the violation of the acts are very heavy.

As a result, no rational doctor or specialist in the health sector wishes to trade patient's data for any price. Although different state governments are highly determined to achieve absolute confidentiality for health records, the protection initiatives should not breach the quality of service. This can be achieved through the establishment of international standards that protect both the welfare of the patient; as well as the doctor responsible for service provision.

Advantages of applying IT systems in healthcare organizations

Apart from compliance with the law, the implementation of EHR has several advantages both to the hospital management and patients. Installation of IT systems in hospitals helps in saving a great deal of the hospital's revenue. By 2005, researchers found that the average hospital with fully installed IT systems could save up to 81 billion dollars in a normal financial year (Emily, 2013). In a manual system where records are stored in a physical file, the management is forced to invest heavily on labor for record maintenance. To add onto the cost, the manual system is highly inefficient and leads to loss and mismanagement of patient's information.

Implementation of IT systems in healthcare organizations helps in improving the quality of service to patients. Quality services in a hospital may entail several elements which include reception, confidentiality of personal information, and provision of correct medical prescriptions and maintenance of the set code of conduct (David & Marilyn, 2010). Use of computerized systems helps in identifying suspicious patterns, reminding clinicians of the appropriate, and identifies mistakes at the initial stages. The system will also ensure clarity since it is easier to read a typed prescription than a hand written one. This way mistakes made by health officers in prescription and dosage are corrected before they reach the patient.

A very critical advantage drawn from the implementation of IT systems is patient empowerment. With the use of IT systems, patients are allowed access to their medical records. This way they check their records at will and are in a position report cases of malpractice or malicious alterations in their records. With IT systems patients suffering from diabetes can track the A1C levels and take better control of their health (Emily, 2013). On the other hand, devices some IT assist people suffering from stroke in communication. In both cases, the patients have better management of their health.

Prospects for healthcare facilities in the next two decades

The rate of technological advancement in the world is very high. There are prospects that laptops will soon become obsolete as a result of the fast growing computing industry. Within the next two decades, two occurrences are possible regarding computerization of medical operations. The first one is the full installation of secure electronic medical records in all the medical facilities. This will guarantee an almost error free healthcare platform in the world. The other possible scenario is the use of artificial intelligence in disease management. Such a system would involve electronic detection of diseases and identification of the stage of infection without interviewing the patient.

Conclusion

To sum up the discussion, implementation of electronic medical records is an important milestone concerning healthcare. Quite a number of health facilities have adopted the use of computerized systems instead of the physical record files. Still, a considerable percentage of health facilities are partially computerized while others are reluctant to implement IT systems. Although some medical facilities have acknowledged the use of computerized systems others still do not believe that the systems are sufficient. Those opposing the use of IT systems to manage patient's records have raised a number of security concerns as well as cost. Even so, the benefits of IT systems outdo the shortcomings. They are not only beneficial to professional in the medical field but also to patients and the process of treatment.

References

Busch, R. S. (2008). Electronic Health Records: An Audit and Internal Control Guide. Hoboken: John Wiley & Sons.

David. M.D. & Marilyn . R.N., (2010) .The ‘Meaningful Use’ Regulation for Electronic Health Records. New England Journal of Medicine

Emily Friedman (2013). Why Are Some Providers Reluctant to Embrace Health Information Technology.Journal of health and health networks.

The concept of meaningful use in relation to the HITECH act seeks to promote the use of certified Electronic Health Records (EHR) to ensure efficiency and effectiveness in the exchange of health information using electronic means with the aim of improving the quality of healthcare (Joneidy, and Maria 8). Also, meaningful use is set to ensure that providers adopting the use of certified EHR technology meet the requirements of the measures required and submits this information to the Secretary of the HHS. Eligible professionals and hospitals who demonstrate excellent adoption of certified EHR technology are awarded grants.

Meaningful Use Stage 1 and 2

Published in 2010, CMS requirements for meaningful use stage 1 are divided into 10 menu set objectives where eligible entities have to meet at least 5, as well as 15 core set objectives (CDC). These measures are to be met by Eligible Professionals (EP) as well as Eligible Hospitals (EH). Meaningful Use stage 2 final requirements were released on August 23, 2012. The criteria for certification of electronic health records was also released along with the measures for EP’s and EH’s (Alfayez, Sandra, and Terri 24). Unlike Stage 1, Stage 2 Meaningful use require eligible professionals to meet 17core objectives as well as 3 out of 6 menu objectives (CDC). Eligible hospitals, on the other hand, must meet 3 out of 6 menu objectives and an exclusion of 16 core objectives.

Meaningful Use Stage 3

Meaningful Use Stage 3 (2015 - 2017) which is optional in 2017 but becomes mandatory in 2018 requires that EPs must meet a combination of any two measures out of 5 (CDC). EHs, on the other hand, must meet a combination of any four measures out of 6.

Reference

Alfayez, Osamah M., Sandra Leal, and Terri Warholak. "Documenting Stage 1 and 2 Meaningful Use criteria: A comparison of clinical pharmacists with other healthcare providers." American Journal of Health-System Pharmacy75.5 Supplement 1 (2018): S24-S28.

CDC. Meaningful Use. 18 January 2018. https://www.cdc.gov/ehrmeaningfuluse/introduction.html. 6 October 2018.

Joneidy, Sina, and Maria Burke. "Towards a deeper understanding of meaningful use in electronic health records." Health Information & Libraries Journal (2018).

Browse More Essay Topics 24/7/365 Support 11+ Yrs in Essay Writing Pay for Quality not Quantity Score that A+ Grade

Affordable Papers

Research Paper for Sale

Cheap Research Papers

Buy Term Papers

Buy Research Paper

Write My Paper

Buy an Essay

Cheap Essay Writer

Write my Essay

Thesis Help

Dissertation Help

Paper Writing Service

Pay for Homework

Pay for Research Paper

Do My Essay for Me

Pay for Essay

College Papers for Sale

Do My Homework for Me

College Essays for Sale

Buy Research Papers Online

Buy College paper

Client: "(Berlin, G.K., CA)"

Topic title:"Leadership shortfalls in Blue Chips"

Discipline: "Economics"

Pages: 5, (APA)

" Awesome, the writer delivered it as required by the professor. They also sent me a plagiarism & grammar report Wow!. I was worried about how the essay would turn up but this is exactly what wanted. Thank you and will be back with a longer essay"

Accounting Research Papers

Business Research Papers

Communication Research Papers

Computer Science Research Papers

Economic Research Papers

Film Studies Research Papers

Finance Research Papers

Geography Research Papers

History Essays

Psychology Research Papers

Political Science Research Papers

Nursing Research Papers

Mathematics Essays

Management Essays

Literature Essays

Law Essays

World Affairs Essays

Technology Essays

Sociology Essays

Science Essays

Religion Essays

+1(209) 348-9544

Terms

Privacy

Sitemap

Frequently Asked Questions

0% Plagiarism Guarantee

Money Back Guarantee

Revision Policy